6 Transformative Steps for Data Entry for Finance Teams in 2026

Why Modern Data Entry for Finance Teams Requires AI

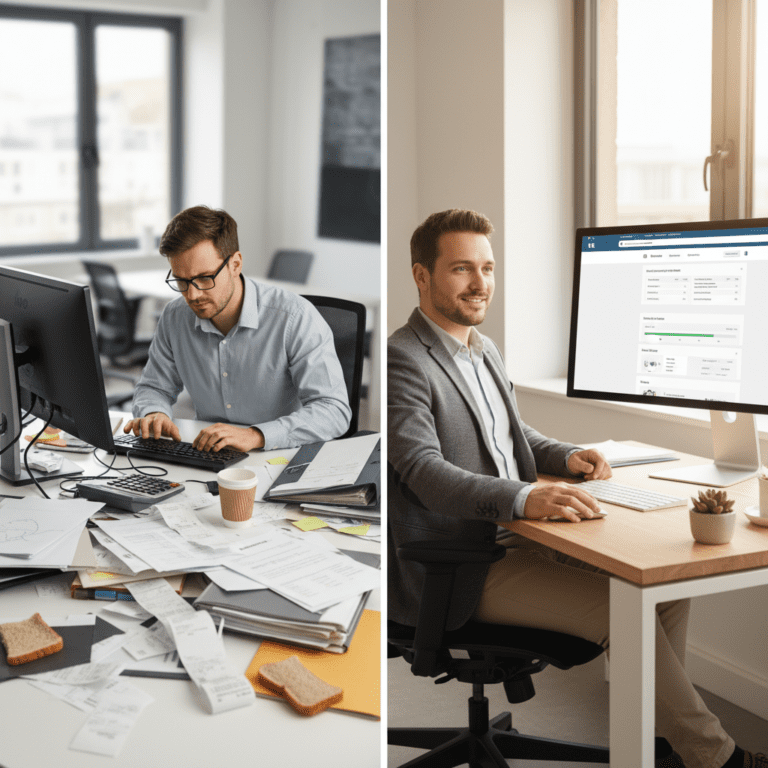

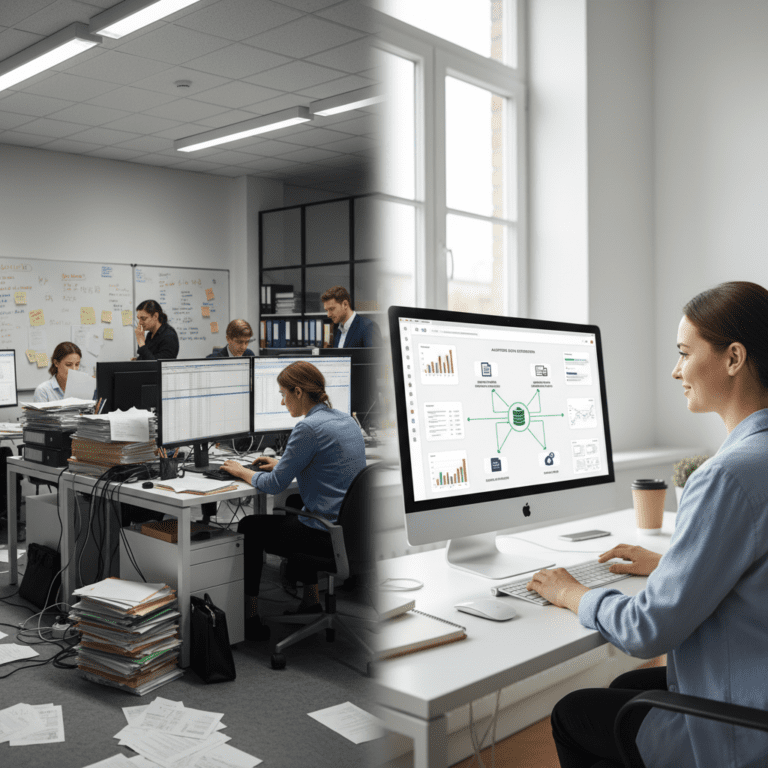

Modern Data Entry for Finance Teams is undergoing a massive shift, as professionals often find themselves overwhelmed by manual tasks. Studies show that hour after hour, your accounts payable team is painstakingly sifting through invoices and inputting data line by line. This routine work leads to high-stress levels, frequent errors, and ultimately, employee burnout.

However, with the advent of AI-powered solutions, the picture shifts dramatically. Imagine switching from this exhausting practice to simply uploading an invoice, where accurate data is extracted in seconds. This transformation frees up valuable time for your team, allowing them to engage in strategic tasks rather than mind-numbing data entry. In the finance sector, every second counts, and automating data extraction not only saves time but also boosts accuracy and employee morale.

The real challenge with Data Entry for Finance Teams

Manual data entry poses significant challenges for finance teams. In a world driven by data, teams often become overwhelmed by paper invoices, leading to inefficiencies and frustration. According to a report, finance teams spend nearly 40% of their time on data entry tasks. This not only eats into productivity but also creates a high risk of data discrepancies and errors. For instance, even the most diligent employee can make a simple input mistake, which could lead to costly financial repercussions. Additionally, manual processes can hamper the speed at which a team operates. This can lead to delayed payments and can potentially harm relationships with vendors. The pressure of tight deadlines and increasing workloads can contribute to employee dissatisfaction and burnout. Clearly, the traditional methods present a myriad of issues for modern finance teams.

Manual vs. automated approach

Before (Manual):

- Pain point 1: Teams often deal with overwhelming amounts of paperwork, increasing stress levels.

- Pain point 2: Errors frequently occur during data entry, leading to financial discrepancies.

- Pain point 3: Manual processes limit real-time data access, slowing down decision-making.

- Pain point 4: High turnover rates can occur due to employee burnout from repetitive tasks.

After (Automated):

- Benefit 1: AI engagement optimizes Data Entry for Finance Teams, reducing processing time by up to 80%.

- Benefit 2: Enhanced data accuracy is achieved, as AI minimizes human error in the extraction process.

- Benefit 3: Workflow efficiency improves significantly, leading to faster approval times and on-time payments.

- Benefit 4: Employee morale increases as teams are liberated from monotonous tasks, fostering a more innovative work environment.

How it works in practice

Implementing AI in your data processing workflow consists of several streamlined steps:

- Step 1: Upload invoices directly into the AI system, eliminating the need for manual handling.

- Step 2: The AI analyzes the documents, employing advanced techniques to identify and categorize relevant data.

- Step 3: Data is extracted with high precision, often in real-time, and ready for review.

- Step 4: Teams can validate and correct any discrepancies through an easy-to-use interface.

- Step 5: Approved data is then integrated into existing systems, ensuring a seamless workflow.

- Step 6: Reports can be generated for real-time insights, assisting in strategic financial planning.

Case Study: EuroAccountants’ Strategic Pivot

EuroAccountants, a mid-sized financial firm, was losing nearly 40% of its productive hours to manual Data Entry for Finance Teams. Their accounts payable department processed thousands of diverse invoices monthly, resulting in high error rates and employee turnover.

After implementing an AI-driven automation strategy, the firm successfully reduced data processing time by 80%. Accuracy improved to near-perfection, allowing the team to transition from clerical work to high-level financial analysis. Within six months, employee morale reached an all-time high, and operational costs dropped by 25%.

Common mistakes to avoid

- Mistake 1: Failing to assess the specific needs of your finance team can lead to a poor implementation.

- Mistake 2: Overlooking the importance of training can impede user adoption of the new system.

- Mistake 3: Neglecting to continuously monitor the system’s performance can result in missed opportunities for optimization.

- Mistake 4: Underestimating the transition period can overload your team during the change.

- Mistake 5: Not considering data security protocols can leave organizations vulnerable to risks.

Best practices data entry for Finance Teams

Follow these best practices for Data Entry for Finance Teams to ensure a smooth transition to AI.

- Actionable tip 1: Conduct a needs assessment to customize the AI solution for optimal performance.

- Actionable tip 2: Provide comprehensive training for all team members to ensure smooth adoption.

- Actionable tip 3: Set measurable goals to gauge the effectiveness of automated processes.

- Actionable tip 4: Regularly review workflows to identify areas for further improvement.

- Actionable tip 5: Prioritize data security and compliance to safeguard sensitive information.

The stark contrast between a stressed, overwhelmed finance team surrounded by piles of invoices and a relaxed, efficient team reviewing data on their screens showcases the pivotal impact of automation. By leveraging AI, organizations position themselves to enhance productivity, reduce errors, and improve overall employee satisfaction.

Organizations looking for intelligent document processing solutions can streamline these workflows significantly.

Optimizing Data Entry for Finance Teams is no longer optional in 2026—it is a necessity.

Frequently Asked Questions about Data Entry for Finance Teams

Q: How does automated invoice processing save time?

A: By rapidly extracting and validating data from invoices, automation reduces manual entry time dramatically, allowing teams to focus on higher-value tasks.

Q: What are the benefits of AI data extraction?

A: AI data extraction improves data accuracy, speeds up processing times, and enhances overall operational efficiency.

Q: Can automated systems reduce employee burnout?

A: Yes, by eliminating repetitive tasks, automation enhances job satisfaction and employee morale.

Q: How does document automation improve workflow efficiency?

A: Document automation reduces manual input errors and speeds up the overall processing time, facilitating quicker decision-making.

Disclaimer: All comparisons in this article are based on publicly available information and our own product research as of the date of publication. Features, pricing, and capabilities may change over time.