8 Powerful Steps to Master AI-Powered Data Extraction in 2026

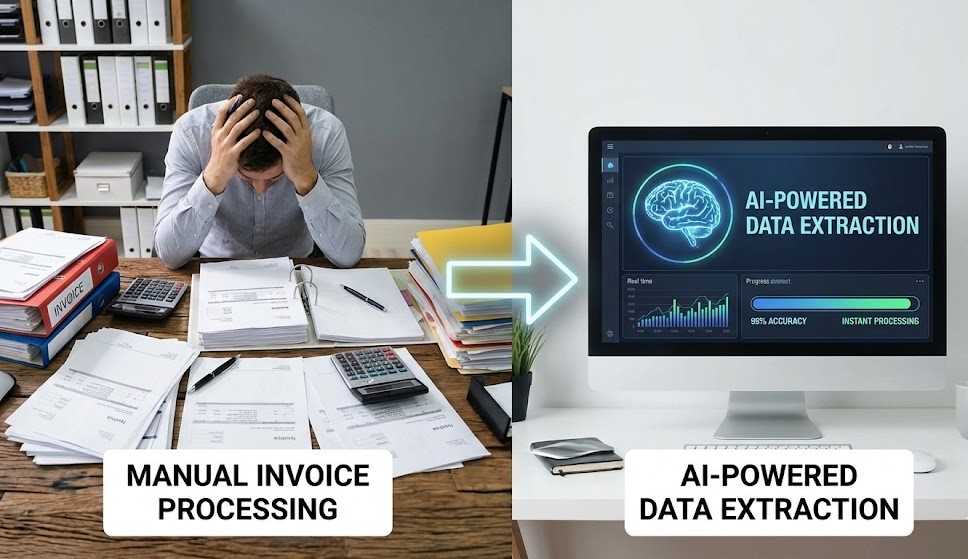

AI-Powered Data Extraction allows you to imagine processing hundreds of invoices every month with total ease. In many finance departments, manual data entry consumes hours, leading to errors and potential cash flow disruptions. With AI-powered data extraction, businesses can revolutionize their operations by automating invoice processing and minimizing the risk of human fatigue. By reducing errors from 30% to nearly 0%, this approach can significantly improve your payment accuracy and speed, ensuring that your team can concentrate on strategic priorities instead of mundane tasks.

The image illustrates a transition in invoice processing; a cluttered office desk contrasts with an organized workspace highlighting AI-powered data extraction benefits.

What is AI-Powered Data Extraction?

AI-powered data extraction refers to innovative technologies that automate the capture and processing of invoice data. This method utilizes machine learning algorithms and Optical Character Recognition (OCR) to interpret and input data from invoices into financial systems with minimal human intervention. By leveraging these powerful tools, accounts payable teams become more efficient, allowing companies to make informed decisions quickly and with greater accuracy.

Why this problem matters in the industry

The challenges associated with manual invoice processing can greatly affect a business’s operational efficiency. A study conducted by the Institute of Finance and Management indicates that organizations relying on manual workflows are 30% less efficient. Such inaccuracies can lead to late payments and strained relationships with suppliers. As a result, implementing technologies like invoice OCR automation is crucial for companies looking to maintain profitability and foster strong partnerships.

Manual vs. automated workflow

Before automation (Manual workflow)

- Accounts payable teams are often burdened with reconciling multiple invoices, leading to significant time losses.

- Manually extracting data from invoices involves checking PDFs and typing information, increasing the risk of errors.

- Tracking down missing invoices can disrupt payment schedules and cause vendor dissatisfaction.

- Human fatigue and repetitive tasks lead to decreased employee morale and efficiency.

After automation (Improved workflow)

- Reduced data entry time allows for faster payment cycles, improving cash flow management.

- Error rate decreases from 30% to nearly 0%, enhancing overall data accuracy workflows.

- Closer monitoring of invoice statuses leads to better visibility of financial operations.

- Employees can shift focus from menial tasks to strategic activities that drive growth.

How AI-Powered Data Extraction works in practice

The typical workflow using AI-powered data extraction comprises several key steps:

- Step 1: The system scans incoming invoices, whether digital or paper-based, utilizing OCR technology.

- Step 2: Data is extracted, including vendor names, amounts, and due dates, with up to 99% accuracy.

- Step 3: The extracted information is automatically categorized and matched against existing purchase orders.

- Step 4: Invoices are flagged for review if discrepancies are detected, streamlining the approval process.

- Step 5: Approved invoices are automatically entered into the financial system for prompt payment.

- Step 6: Historical data on invoicing patterns is analyzed to inform future financial strategies.

- Step 7: Notifications are sent to relevant parties regarding payment statuses, enhancing communication.

- Step 8: The system continuously learns from past data to improve accuracy in future processes.

Case Study: Global FinTech Solutions’ Accuracy Leap

Global FinTech Solutions was already using basic OCR, but they still suffered from a 30% error rate due to diverse invoice templates. By upgrading to our recommended 8-step AI-Powered Data Extraction workflow, they achieved a staggering 99% accuracy rate within weeks.

This transition didn’t just fix errors; it eliminated human fatigue and allowed their accounts payable team to process 5,000+ invoices monthly without adding staff. Their payment speed increased by 40%, significantly strengthening their vendor partnerships and overall profitability.

Common mistakes to avoid

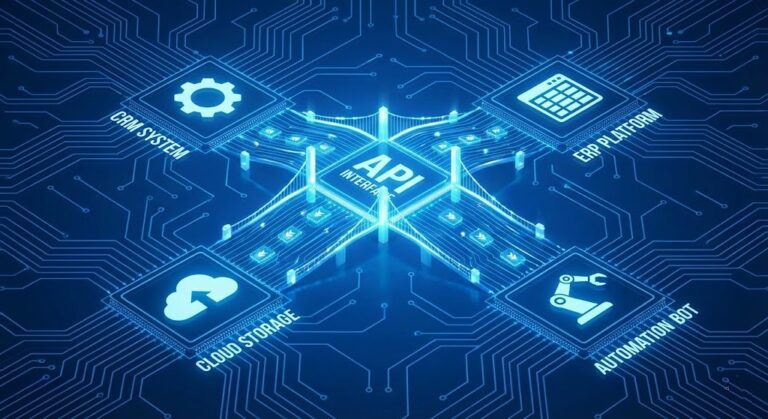

- Overlook integration: Ensure the tool fits seamlessly with your existing financial software.

- Ignoring employee training: Train staff on new systems to facilitate smoother transitions.

- Underestimating data quality: Regularly review data accuracy to improve outcomes.

- Neglecting scalability: Choose solutions that can grow with your organization’s needs.

- Failing to set KPIs: Establish clear metrics to assess the effectiveness of automation.

Best practices for AI-Powered Data Extraction

- Conduct a thorough needs assessment before selecting an automation tool.

- Involve team members from various departments during implementation.

- Regularly update the software to benefit from the latest features and security measures.

- Foster a culture of innovation, encouraging staff to suggest improvements.

- Utilize analytics to measure success and identify areas for further optimization.

This article explores a visual transition from chaos to efficiency, showcasing how manual processing leads to disarray in financial workflows, while automated solutions create a streamlined environment where data is effortlessly managed and processed.

Mastering AI-Powered Data Extraction is the key to financial agility in 2026.

FAQ about AI-Powered Data Extraction

Q: What are AI-powered data extraction tools?

A: These tools employ machine learning and OCR to automate the extraction and processing of data from invoices, significantly reducing human error and processing time.

Q: How easily can AI-powered data extraction integrate with existing systems?

A: Most AI-powered data extraction solutions are designed to integrate smoothly with popular accounting and financial systems, ensuring a seamless transition.

Q: What kind of ROI can companies expect from implementing these solutions?

A: Companies can expect significant ROI through cost savings from reduced labor hours, enhanced accuracy, and improved supplier relationships.

Q: How can businesses benefit from automating their invoicing process?

A: Organizations that implement AI-Powered Data Extraction see an immediate ROI through a 30% increase in operational efficiency, the total elimination of manual entry errors, and significantly faster payment cycles that optimize overall cash flow management.

Disclaimer: All comparisons in this article are based on publicly available information and our own product research as of the date of publication. Features, pricing, and capabilities may change over time.