8 Incredible Steps to Master Real Estate Invoice Automation in 2026

Tired of the tedious process of manual data entry in your property management business? Implementing Real Estate Invoice Automation is the ultimate solution for finance teams trapped in a cycle of error-prone tasks. Imagine scanning piles of contractor bills and spending hours transcribing data into spreadsheets this practice not only delays your monthly closing but increases operational risk.

What is Real Estate Invoice Automation?

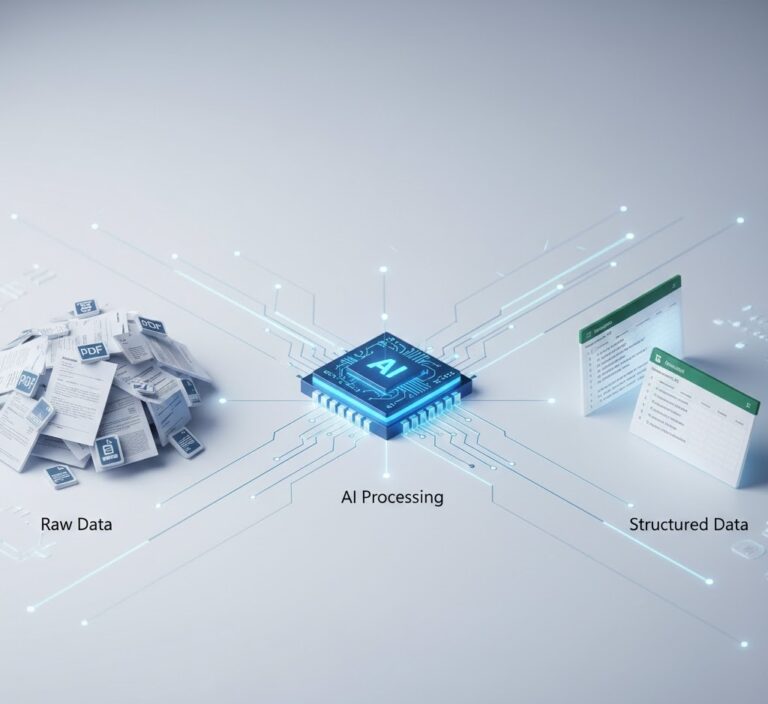

Real Estate Invoice Automation is an innovative tool that allows companies to automate the extraction of crucial data from various property-related documents. This technology leverages machine learning and an AI-powered invoice parser for finance teams to recognize data points, transforming them into structured formats for your ERP system.

Why this problem matters in the industry

According to an industry study, 80% of finance teams report that manual invoice processing is a major source of frustration and inefficiency. This inefficiency can significantly impact overall productivity and operational accuracy. Moreover, with increasing compliance requirements and audit pressures, having a robust system for handling invoices is paramount. Automated solutions not only streamline workflows, but they also mitigate risks associated with human error, allowing finance teams to focus on strategic initiatives instead of mundane data entry tasks.

Manual vs. automated workflow

Before automation (Manual workflow)

- Data entry errors can arise while reconciling invoices with purchase orders, leading to financial discrepancies.

- Manually checking PDFs for the correct totals consumes invaluable employee time, diverting attention from core financial analysis.

- Overwhelmed finance teams may experience delays with monthly closings due to burdensome invoice processing.

- Maintaining an organized filing system becomes a challenge, resulting in lost invoices and disarray in financial records.

After automation (Improved workflow)

- Teams can save up to 70% of their processing time, as reported by one of our clients who integrated automated software.

- Error rates drop significantly, minimizing costly inaccuracies that could affect financial reporting.

- Faster monthly closing processes enable finance departments to gain insights and make strategic decisions in real time.

- Enhanced visibility into operations allows for more straightforward audits and compliance management.

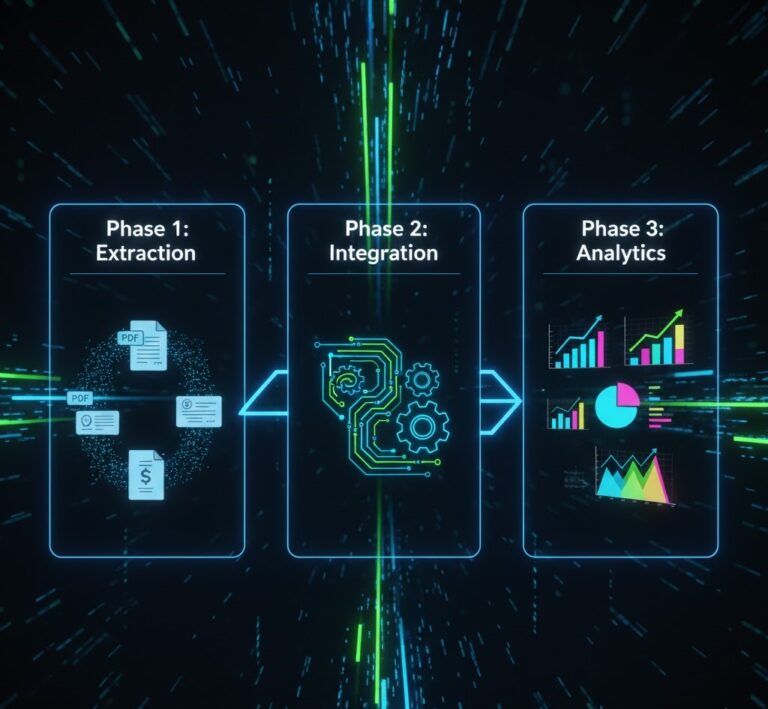

How Real Estate Invoice Automation Works in Practice

The workflow for implementing Real Estate Invoice Automation involves several straightforward steps:

- Step 1: Scan physical invoices or upload PDF files to the automated system.

- Step 2: The parser uses OCR (Optical Character Recognition) to identify and extract relevant data points.

- Step 3: The extracted data is then verified against predetermined accuracy thresholds using AI algorithms.

- Step 4: The Real Estate Invoice Automation system converts data into CSV or Excel format.

- Step 5: The system flags discrepancies for manual review, allowing for quicker resolution of issues.

- Step 6: Once the data is validated, it flows seamlessly into the company’s ERP or accounting systems.

- Step 7: Finance teams receive real-time access to analytics and dashboards featuring the processed data.

- Step 8: With reduced manual efforts, teams can focus on strategic financial planning and analysis.

Common mistakes to avoid

- Rushing the implementation process without proper testing can lead to costly setbacks always pilot the system first.

- Neglecting employee training can result in underutilization of the software; adequate guidance is essential.

- Not integrating with existing financial systems can cause data silos ensure compatibility from the start.

- Focusing solely on short-term gains without considering long-term R.O.I can hinder future scalability.

- Overlooking compliance requirements can expose organizations to regulatory risks be proactive in alignment.

Best practices Real Estate Invoice Automation

- Regularly update the AI models to improve accuracy as data sets evolve and new invoice formats arise.

- Encourage user feedback for constant improvement of the automated system.

- Set clear KPIs related to data extraction efficiency and accuracy for continuous performance evaluation.

- Establish a balanced approach, integrating both AI automation and human oversight for best results.

- Communicate the advantages of the system to all stakeholders to support change management initiatives.

As finance teams transition from a chaotic environment filled with physical invoices to a streamlined digital workspace, they not only improve processes but also enhance productivity. The contrast between cluttered desks and the elegance of clear, visual dashboards illustrates the power of using technology to overcome traditional hurdles.

If you’re interested in discovering how to transform your finance processes, consider enhancing your workflow with an automated invoice data extraction solution that can deliver unrivaled time savings and accuracy in processing.

FAQ about the Real Estate Invoice Automation

Q1: How does the AI-powered invoice parser for finance teams improve accuracy in data entry?

A: The AI-powered invoice parser uses advanced machine learning algorithms to verify data against multiple parameters, significantly reducing human error during data entry.

Q2: What benefits can my finance team expect after implementing this solution?

A: Teams can expect considerable time savings, reduced error rates, faster closing times, and improved audit readiness after implementing the AI-powered invoice parser.

Q3: How can we integrate the AI-powered parser with our existing ERP system?

A: Most automated invoice data extraction software provides APIs that easily integrate with various ERP systems, ensuring a seamless flow of data.

Q4: What kind of return on investment can we anticipate from using an AI-powered invoice parser?

A: Organizations can anticipate a quick R.O.I through reduced labor costs, minimized errors, and accelerated processing times, often resulting in significant operational savings.

Disclaimer: All comparisons in this article are based on publicly available information and our own product research as of the date of publication. Features, pricing, and capabilities may change over time.