Transform Your Utilities Billing with Automated Data Extraction

As utility finance professionals, we understand the significant challenges posed by manual data entry. According to recent studies, more than 60% of finance teams spend excessive hours inputting data from invoices and payment records into their billing systems. This tedious process is error-prone and diverts valuable resources from more strategic initiatives. But what if I told you that with automated data extraction, invoices could be processed seamlessly? Imagine the time saved and the accuracy gained as data flows effortlessly into your financial systems, freeing your team to focus on what truly matters.

What is automated data extraction?

Automated data extraction refers to the process of utilizing advanced technologies, often powered by AI, to capture and process data from documents like invoices and payment records without human intervention. This innovative technique allows finance teams to drastically reduce time spent on tedious tasks, minimizing human error and enhancing overall data accuracy. Instead of a manual workflow reliant on spreadsheets, organizations can implement a streamlined approach where data is swiftly extracted, validated, and integrated into their accounting systems.

Why this problem matters in the industry

The significance of automating financial data is underscored by the increasing complexity of billing systems. According to a study by the International Data Corporation (IDC), nearly 30% of finance professionals experience persistent inaccuracies due to manual entry errors. This impacts cash flow analysis and decision-making processes, leading to delayed financial reporting and decreased efficiency. By addressing the challenges of manual data entry, organizations can improve data accuracy workflows and transform their financial operations.

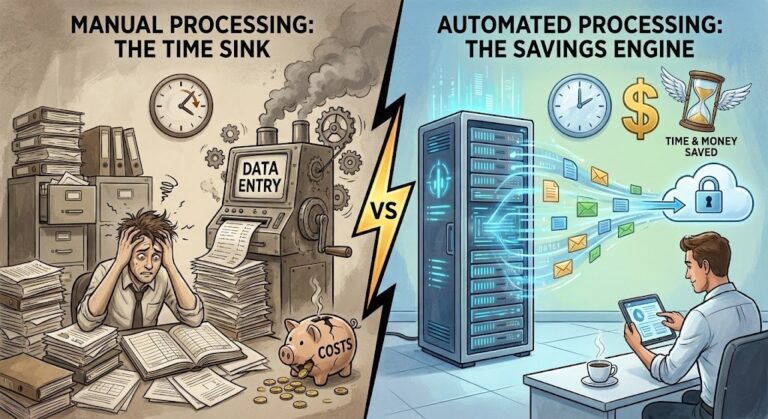

Manual vs. automated workflow

Before automation (Manual workflow)

- Teams manually reconcile invoices, leading to potential delays in payment processing.

- Checking PDFs or physical invoices for discrepancies takes up valuable time.

- Considerable hours wasted on spreadsheets result in nondynamic cash flow analysis.

- Increased risk of errors caused by repetitive data entry across multiple documents.

After automation (Improved workflow)

- Time saved through automated processes allows finance teams to tackle strategic initiatives.

- Drastically improved accuracy, reducing discrepancies in financial reports.

- Faster closing of accounting periods due to immediate access to essential data.

- Enhanced visibility over financial operations enables timely responses to inquiries.

How automated data extraction works in practice

Implementing an automated data extraction process involves several key steps:

- Step 1: Begin by identifying all relevant documents, such as invoices and receipts, needed to extract data.

- Step 2: Select a reliable automated data extraction tool that caters to your specific industry requirements.

- Step 3: Configure the tool to recognize key data points, such as invoice numbers, dates, and amounts.

- Step 4: Allow the system to capture and process data from incoming documents automatically.

- Step 5: Monitor the extraction process to ensure accuracy in real-time.

- Step 6: Validate extracted data against the source document to confirm its correctness.

- Step 7: Integrate the verified data into your billing system with minimal manual input.

- Step 8: Review the entire workflow regularly to optimize performance and scalability.

Case Study: Spark Utility’s Billing Revolution

Spark Utility, a provider serving 10,000+ households, struggled with a 30% error rate in their manual billing cycle. By following our recommended 8-step Automated Data Extraction workflow, they reduced data entry time by 80%.

Not only did they eliminate billing discrepancies, but they also accelerated their monthly closing process from 10 days to just 48 hours. This transition allowed their finance team to shift from clerical tasks to advanced cash flow forecasting, saving the organization an estimated $85,000 in annual labor overhead.

Common mistakes to avoid

- Neglecting to train staff; ensure your team understands the new system thoroughly.

- Failing to validate data extraction results; always confirm the accuracy of extracted data against source documents.

- Choosing the wrong tool; assess various options based on specific utility finance needs.

- Ignoring scalability; make sure the solution can grow with your organization’s data requirements.

- Overlooking compliance; ensure all data practices meet industry regulations to avoid future penalties.

Best practices

- Regularly update your automation tools to leverage the latest advancements in AI.

- Incorporate user feedback into your system for continuous improvement and usability.

- Foster a culture of transparency by sharing the benefits of automation with the entire finance team.

- Establish clear data entry guidelines to complement automation practices.

- Conduct periodic audits of the extraction process to maintain high-quality standards.

Consider the juxtaposition between a cluttered space filled with paper invoices and stressed finance professionals compared to an organized, digital environment showcasing automated data analytics. This visual transformation underscores the impact of switching from manual to automated data processes.

For those looking to optimize financial workflows, we invite you to explore how our AI-powered document extraction engine can enhance efficiency, accuracy, and compliance in your utility billing operations.

FAQ about automated data extraction

Q1: What is automated data extraction?

A: Automated data extraction refers to the use of AI and machine learning technologies to automatically extract relevant data from documents without human intervention, ensuring speed and accuracy in financial processes.

Q2: How does automated data extraction improve billing efficiency?

A: By automating data extraction, organizations can eliminate repetitive manual entry, reducing errors and the time taken to reconcile payments and generate reports.

Q3: How easy is it to integrate automated data extraction with existing systems?

A: Most modern automated data extraction tools are designed for seamless integration with existing accounting or billing systems, often through API connections or direct data uploads.

Q4: What kind of ROI can be expected from implementing automated data extraction?

A: Organizations can expect a significant return on investment through reduced labor costs, faster processing times, and improved data accuracy, ultimately leading to better financial decision-making.

Disclaimer: All comparisons in this article are based on publicly available information and our own product research as of the date of publication. Features, pricing, and capabilities may change over time.