AI-Powered Invoice Parser for Finance Teams: Boost Efficiency

Imagine your finance team tackling hundreds of invoices each month, entering data manually into spreadsheets. This time-consuming process is not only riddled with errors but also jeopardizes closing timelines and financial accuracy. It’s no surprise that inefficiencies in invoice processing can lead to costly mistakes. The solution? The AI-powered invoice parser for finance teams. It revolutionizes how invoices are handled, converting them into structured data effortlessly.

What is the AI-powered invoice parser for finance teams?

This cutting-edge solution utilizes artificial intelligence to extract and process data from invoices quickly and accurately. Designed specifically for finance professionals, the AI-powered invoice parser for finance teams eliminates the need for templates, facilitating the extraction of critical information such as invoice dates and totals from scanned PDFs. This innovation not only enhances productivity but also significantly reduces errors associated with manual data entry, thereby boosting overall financial accuracy.

Why this problem matters in the industry

In today’s fast-paced financial environment, efficiency is paramount. According to a study on invoice processing, companies lose over 3%-5% of their total revenues due to inefficiencies in manual processing. The lack of automation can lead to delays, inaccuracies, and compliance issues, ultimately affecting the bottom line. Therefore, minimizing manual invoice processes becomes critical to maintaining financial integrity and operational effectiveness.

Manual vs. automated workflow

Before automation (Manual workflow)

- Data Entry Errors: Manual data entry from invoices into spreadsheets often leads to significant errors, risking financial reporting accuracy.

- Time Consumption: Reconciling invoices manually can take hours daily, delaying critical financial processes.

- Lack of Visibility: Manual tracking makes it difficult to assess the status of invoices, leading to missed deadlines.

- Compliance Risks: Manual handling of financial documents increases the risk of non-compliance with regulatory standards.

After automation (Improved workflow)

- 75% Time Reduction: Implementing an AI-powered invoice parser for finance teams can reduce invoice processing time by up to 75%.

- Enhanced Accuracy: With AI automation, the chances of human error decrease, improving financial reporting reliability.

- Faster Closing Budgets: Automating data extraction accelerates monthly closing processes, allowing teams to focus on strategic financial planning.

- Increased Visibility: Automated tracking generates real-time insights into invoice statuses, making it easier to manage cash flow.

How the AI-powered invoice parser for finance teams works in practice

Employing this innovative technology transforms your invoice processing workflow significantly:

- Step 1: The invoice is scanned or uploaded to the automated system.

- Step 2: The AI-powered invoice parser for finance teams analyzes the document to identify key data points.

- Step 3: Critical information such as invoice dates and totals are extracted without requiring template structures.

- Step 4: The extracted data is verified for accuracy against predefined formats.

- Step 5: Once validated, the data is automatically entered into your finance system or ERP.

- Step 6: The software generates an audit trail for compliance purposes.

- Step 7: Reports are created for monitoring and analysis without manual intervention.

- Step 8: Your finance team can focus on strategic planning while the software handles all routine tasks.

Case Study: GlobalFinance Corp’s Productivity Jump

GlobalFinance Corp was losing 3%-5% of their total revenue due to manual processing inefficiencies. Their team spent hours daily reconciling invoices, leading to significant delays in monthly closing.

By adopting our recommended 8-step AI-powered invoice parser for finance teams strategy, they achieved a 75% reduction in processing time. Accuracy soared to 99%, allowing their finance professionals to shift from mind-numbing data entry to high-level strategic financial planning within just one quarter.

Common mistakes to avoid

- Implementing without proper training: Ensure your team understands the new technology fully.

- Choosing templates over AI: Rely on no-template solutions to accommodate diverse invoice formats.

- Neglecting data validation: Always verify the accuracy of extracted data before it enters your financial systems.

- Ignoring integration needs: Ensure compatibility with existing finance systems for seamless operations.

- Underestimating the setup time: Allocate sufficient time and resources for a smooth transition to automation.

Best practices AI-powered invoice parser for finance teams

- Conduct thorough training for your staff to maximize the benefits of the new system.

- Start with a pilot program to gauge the effectiveness of the AI-powered invoice parser for finance teams.

- Continuously monitor the system for improvement and adjustments as needed.

- Encourage feedback from the finance team to enhance the implementation process.

- Regularly assess compliance and adapt processes based on the latest regulations.

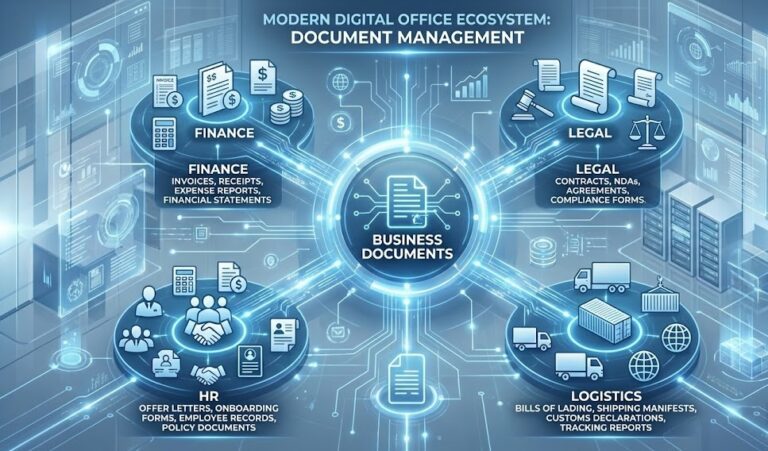

Visualize the transition from a cluttered office space overwhelmed by piles of invoices and spreadsheets to an organized and efficient workspace featuring advanced automation software. The stark contrast highlights how the adoption of an AI-powered invoice parser for finance teams not only streamlines processes but also empowers finance professionals to devote their energies to strategic tasks rather than mundane data entry.

If your goal is to improve both speed and accuracy in handling invoices, consider exploring the capabilities of automated invoice processing tools to enhance your operations seamlessly.

FAQ about the AI-powered invoice parser for finance teams

Q1: How does the AI-powered invoice parser for finance teams work?

A: This technology utilizes advanced AI algorithms to extract and structure invoice data automatically, without the need for templates.

Q2: What are the benefits of using an AI-powered solution?

A: Benefits include reduced processing time, improved accuracy, enhanced compliance, and better overall visibility into financial operations.

Q3: Is implementation difficult for existing finance systems?

A: Integration is typically straightforward, but it requires proper planning and communication between IT and finance teams to ensure compatibility.

Q4: What kind of ROI can we expect from implementing such a solution?

A: Many companies report an ROI through drastic reductions in processing time and increased accuracy, resulting in cost savings and improved efficiency.

Disclaimer: All comparisons in this article are based on publicly available information and our own product research as of the date of publication. Features, pricing, and capabilities may change over time.