Transforming Data Entry with Automated Invoice Processing

Automated invoice processing is the most effective way to transform your business, as manual data entry is not just tedious; it’s a productivity killer. Did you know that a single finance team member can spend upwards of 15 minutes typing invoice details from PDFs? The future of the finance function.

With numerous invoices coming in daily, this adds up to hours lost that could be spent on more strategic tasks. This inefficiency not only drains valuable time but also leads to errors that can have financial repercussions. Luckily, businesses can transform their processes with automated invoice processing, where data extraction is done efficiently with just a click. Let’s explore how automation can redefine data entry for your organization.

The real challenge with manual data entry

Manual data entry can absorb a significant part of a finance team’s daily routine. A study shows that employees can spend up to 70% of their time on manual entries. This inefficiency can lead to various problems, such as lack of data accuracy, employee burnout, and delayed decision-making. For instance, when teams must sift through piles of invoices, errors become inevitable; 40% of organizations have reported inconsistencies due to manual entry. These complications extend beyond just financial metrics and affect overall workflow efficiency, hampering an organization’s growth potential.

Manual vs. automated approach

Before (Manual):

- Systems overloaded with paper invoices leading to high stress and frustration for teams.

- Time-consuming processes that take 10-15 minutes for each invoice, resulting in wasted hours.

- Common data inaccuracies causing discrepancies that complicate reconciliation.

- Inability to scale due to lack of resources dedicated to manual entries.

After (Automated):

- Automated invoice processing can reduce data entry time to mere minutes, significantly improving productivity.

- Enhanced data accuracy through intelligent algorithms minimizes the risk of human error.

- Employees can redirect energy towards strategic initiatives rather than mundane tasks, fostering innovation.

- Scalable solutions that adapt to growing business needs without a corresponding increase in resource allocation.

How Automated Invoice Processing works in practice.

Implementing automated invoice processing is straightforward. Here’s how the transformation typically unfolds:

- Step 1: Data capture – Scanning invoices using OCR (Optical Character Recognition) technology to extract essential information.

- Step 2: Data validation – Automatically verifying extracted information against predefined rules and databases.

- Step 3: Workflow integration – Seamlessly integrating with existing ERP (Enterprise Resource Planning) systems to update records in real-time.

- Step 4: Exception handling – Flagging discrepancies for team review while processing everything else accurately.

- Step 5: Reporting – Generating insightful reports on processing times and error rates to enhance decision-making.

- Step 6: Continuous improvement – Using data analytics to refine processes and improve future invoice processing cycles.

Common mistakes to avoid

- Neglecting to train employees on the new tools, which can lead to user resistance.

- Forgetting to regularly update software, risking vulnerabilities and inefficiencies.

- Lack of consistent data management policies that may hinder the benefits of automation.

- Overlooking the importance of customer feedback in improving processes.

- Failing to monitor results post-implementation, limiting the understanding of ROI.

Best practices

- Invest in proper training for team members to ensure smooth transitions.

- Regularly audit and update processes and tools to keep up with technology advancements.

- Standardize data input formats to facilitate smoother processing.

- Seek employee input on their experiences to identify further areas for enhancement.

- Leverage data analytics to help refine workflows and boost data accuracy continuously.

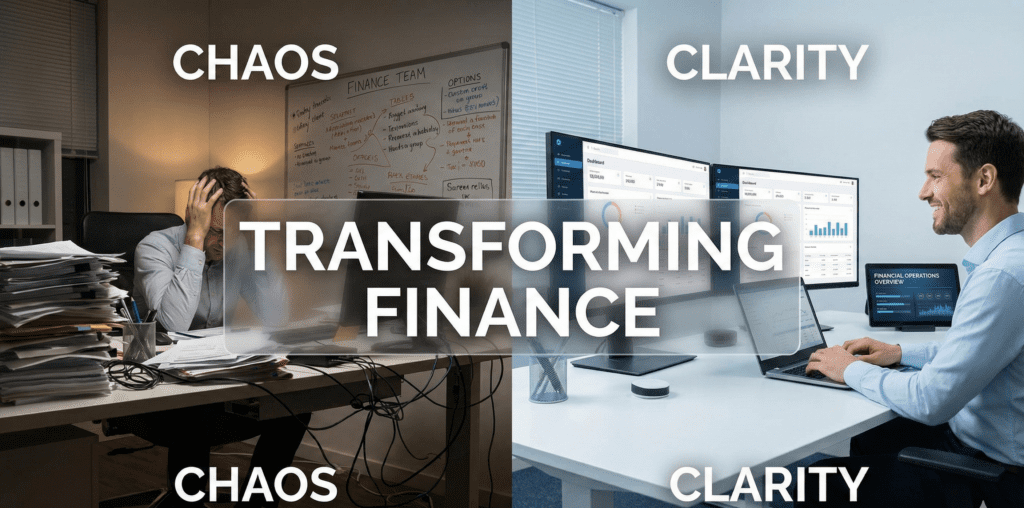

The visual comparison between traditional and automated environments highlights the stark contrast in efficiency and organization. On one side, a cluttered workspace reflects the chaos of manual data entry with an overwhelmed employee, while on the other, the sleek, efficient arrangement of an automated system showcases clarity and productivity in action.

Organizations looking for intelligent document processing solutions can streamline these workflows significantly. Automation doesn’t just save time, it elevates the entire operational ecosystem.

Embracing automated invoice processing ensures your organization remains competitive.

Frequently asked questions

Q: How does automated invoice processing enhance data accuracy?

A: Automated systems utilize advanced algorithms to minimize human error, ensuring higher data integrity.

Q: Is it difficult to transition to automated extraction tools?

A: Transitioning is manageable, especially with proper training and support structures in place.

Q: What are the cost implications of automating data entry?

A: While initial costs exist, the long-term savings in time and accuracy typically yield a substantial ROI.

Q: Can automated systems integrate with existing software?

A: Yes, most automated extraction tools are designed to seamlessly integrate with various ERP systems and databases.

Disclaimer: All comparisons in this article are based on publicly available information and our own product research as of the date of publication. Features, pricing, and capabilities may change over time.